When we all look into the same house through different windows it should

not be a surprise that we may all see different things. It’s the same house

just different perspectives.

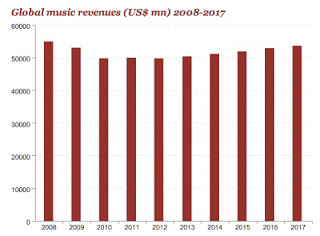

Pricewaterhouse Coopers have just issued a report predicting a 1% annual

growth for the US-based music industry through to 2017. That may put a

smile back on the music executives, who are ready to slit their wrist and could

only see terminal decline. It may disappoint those optimists who believe that

music has turned the corner and would have expected a significant upturn. However,

for many it confirms that the traditional music industry after 100 years of stellar

growth is now seriously flat lining.

Before we all jump in to defend our own viewpoint, we have to accept that

the music industry is going through dramatic change in formats, channels,

culture, and how consumers listen, store and pay for music. It would be somewhat

foolish to predict the outcome in such turmoil. Who will survive and even what

the market may look like in the next decade is open to many prespectives,

interests and even down to the extent that the current culture will change.

Today, digital sales may be increasing, but the value of the units sold is

dropping. Digital sales may still be in their infancy, but are now under

serious threat as Apple’s favour nation starts to faulter, the challenge to

resell digital has only just begun and the demand streamed and subscription

services is only starting to redefine ownership. Even the relatively new swing

from album to singles, which was driven by the likes of iTunes, may not be as

clear cut as once predicted and the single versus the album debate is ongoing for

many. All this without the introduction of Neil Young’s Pono service which may

not happen, but is bound to be followed by others who are wanting better

quality than MP3.

If we look at through Pricewaterhouse Coopers’ revenue window we see a

flat business.

Pricewaterhouse Coopers predict grow in 2013, but based exactly on what?

Physical sales are falling and not being

compensated by digital sales and even the return of vinyl can only be seen as

niche. Kids are increasingly now turning to YouTube to watch and listen and

even if these licences were revisited they would never bring back the glory

days. We see from the recent Apple iRadio negotiations that although the streaming

business appears to be sound it will not feed all the production mouths that

have been built up over the good days.

If we look through another Pricewaterhouse Coopers’ window that shows

the comparative revenues generated by digital as opposed to physical we see a

sick physical patient and a digitally challenged one.

When we look at live revenues the Pricewaterhouse Coopers’ perspective is

more bullish and predicts a 3% growth to some $30.9 million by 2017. They

state that this will "more than offset the continued decline in recorded

music revenues." The question they fail to answer is whether this money

and growth will be owned by the traditional gang of three majors, or now

migrate to others such as Live Nation?

The question also exists about the division between publisher revenues

and recorded revenues and how that split will grow as streaming services grow.

It’s easy to look at music and see a sector that is struggling to compensate

and balance the loss of traditional physical sales revenues with the emerging

digital ones but it’s harder to see how music will generate the same revenues

it once did. It’s the same house but today even the foundations are changing!

No comments:

Post a Comment